malaysia rental income tax deductible expenses

Yes you may still make your deductions from rental tax as normal. They are as follows.

Landlords Here S What You Need To Know Before Filing Your Taxes

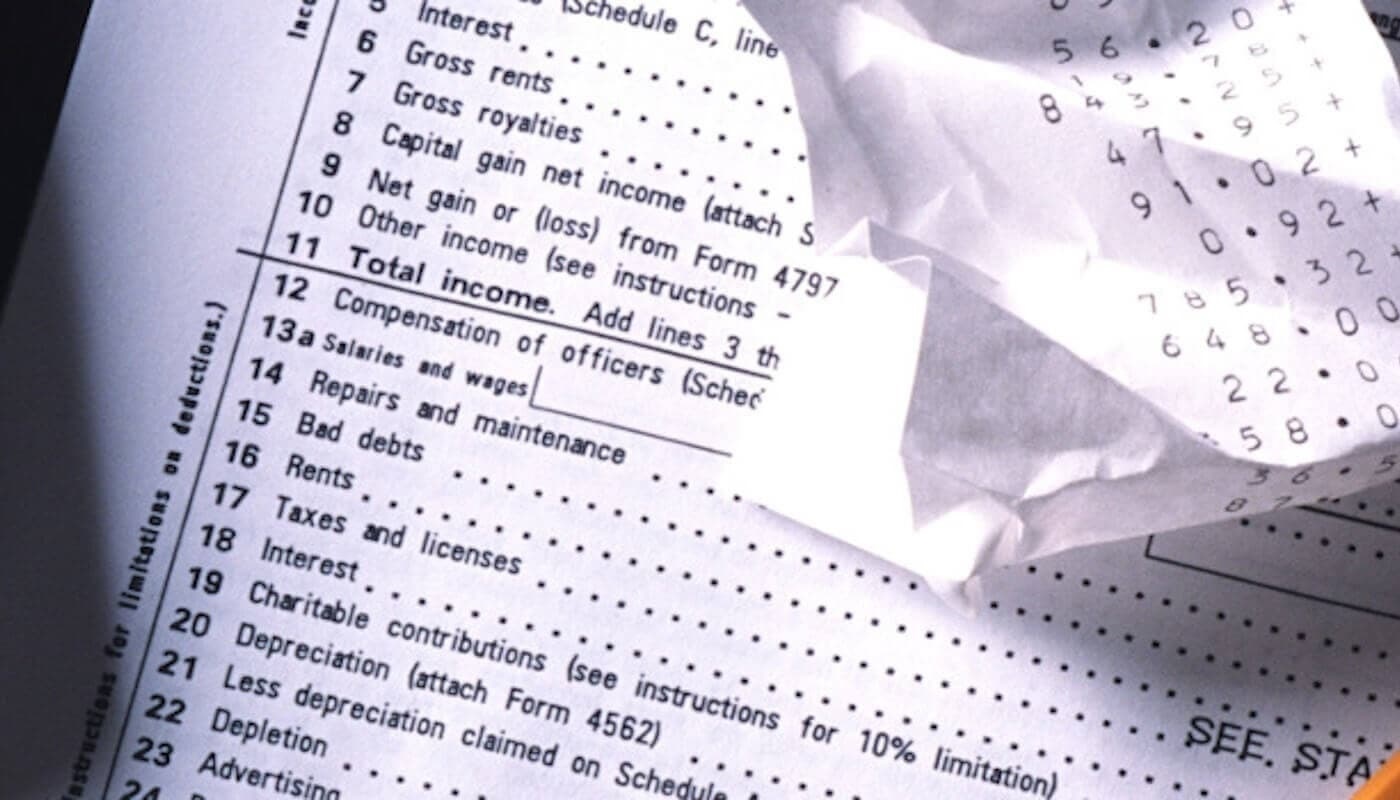

6 rows What Expenses Can Be Deducted From Rental Income In Malaysia.

. Allowable expenses You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes. Expenses not wholly and exclusively incurred in the production of income Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure. The owner can continue claiming the deductible expenses as long as the.

Rent expenses of business premises repair and maintenance of premises plant and machinery loan interest or borrowing. 2 Exchange rate used. However expenses incurred wholly and exclusively in earning the rental income are deductible against.

100 US 400 MYR 3 Estimated values. The net rental income after deduction of any allowable expenses is subject to income tax. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in.

Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source. A Assessment and Quit Rent Annual assessment Cukai Pintu paid half-yearly to local authority such as Dewan Bandaraya Kuala Lumpur and. The deduction is limited to 10 of the aggregate.

There are a handful of expenses that could be deducted from income derived from renting out your property before declaring your rental income to LHDN. Paragraph 33 1 c of the ITA allows. In Adams case his monthly loan repayments are.

What is the deductible expenses. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service. It is taxable from the date it is due and payable to the property owner and not the date of actual.

Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents. The rental income is subject to income tax whereas the capital gain is subject to real property gains tax RPGT. Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source.

In adjusting the income from the rental all expenses incurred wholly and exclusively in the basis period in the production of the gross income are deductible. Paragraph 331c of the ITA allows a. Deductions on taxes from Section 4d of the ITA can be made from direct expenses related to the renting of.

You will only need to pay tax. The deductible expenses can. If your rental income is considered as a non-business income you will need to add the amount youve generated from the rental to your total income.

Employees are allowed a deduction for any expenditure incurred wholly and exclusively in the performance of their duties but no allowance is given for tax depreciation. The expenses that are income tax deductible including. Rental income is taxed at a flat rate of 24.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. The below are some expenditures generally deductible for tax. Rental Income Deductible Expenses.

So what are these. Deductible expenses are costs which can be used to subtract gross rental revenues to derive ones net rental income. No capital allowance is given for the premise or assets provided to earn the rent.

.jpg)

Financing And Leases Tax Treatment Acca Global

Property Rental Income Tax In Portugal For Foreign Owner Investors

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Personal Tax Relief 2021 L Co Accountants

Property Rental Income Deductible Expenses

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

Are Property Management Fees Tax Deductible And Other Tax Questions Answered

8 Things To Know When Declaring Rental Income To Lhdn

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Income Tax Calculator 2020 Malaysia Personal Tax Relief Malaysia Tax Rate

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Newsletter 24 2017 Taxation Of Real Estate Investment Trust Or Property Trust Fund Page 002 Jpg

12 Ways Business Owners Can Save On Taxes Clover Blog

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

.jpg)

Comments

Post a Comment